How Oil Price Shocks Impact African Economies

Credit: Petroleum Commission, Ghana

With 7.5% of global oil reserves according to the BP Statistical Review of World Energy report for 2018 , revenue generated from oil resources in Africa is a key driver of economic growth in energy-exporting countries on the continent – the African Economic Outlook report for 2020 reveals that the economy of Africa grew at 3.4% in 2019 with North Africa, contributing the largest as the region accounted for 44% of economic growth on the continent. The recovery of North Africa after the Arab Spring in 2010 has been remarkable – the boost in growth is partly attributed to revenue from oil. For instance, higher levels of production and export of oil by Libya contributed immensely to the improved economic growth of the region after 2016 . Although other sectors such as agriculture in Morocco played an instrumental role in propelling economic growth in North Africa, as high yield increased economic growth in the North African country from 1.2% in 2016 to 4.1% in 2017, revenue from oil has been the major determinant of growth in the area.

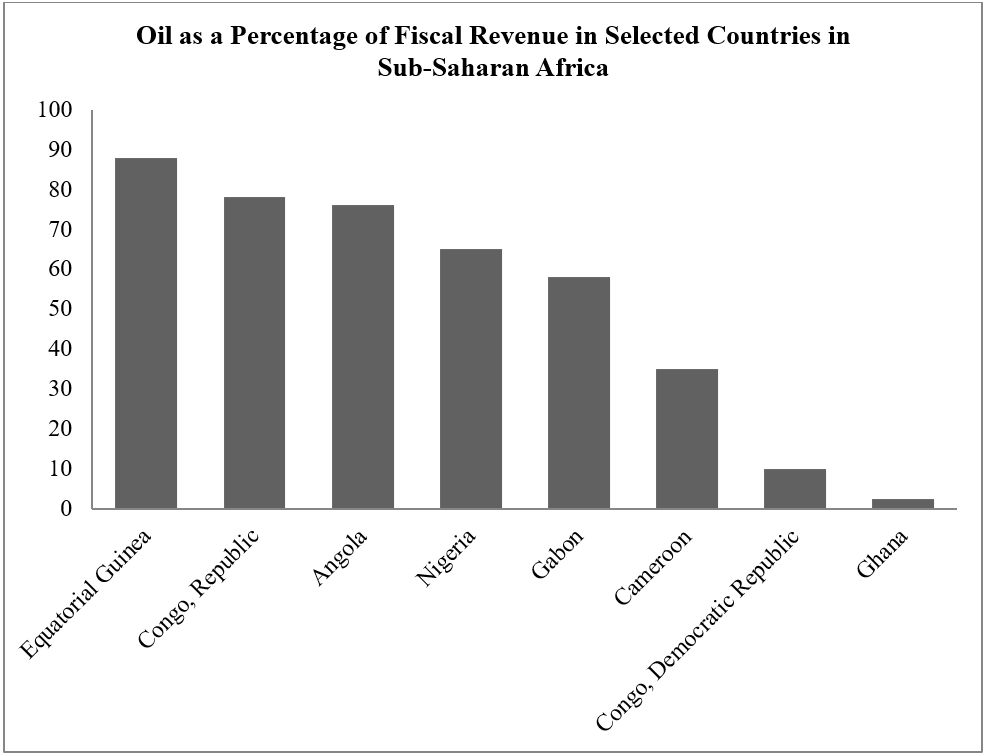

In Sub-Saharan Africa (SSA), where oil exporting countries account for almost 50% of the region’s Gross Domestic Product (GDP), oil contributes as high as 90% of the total fiscal revenue of oil exporting countries and serves as a major source of foreign reserve.

Source: International Monetary Fund (IMF) Country Reports

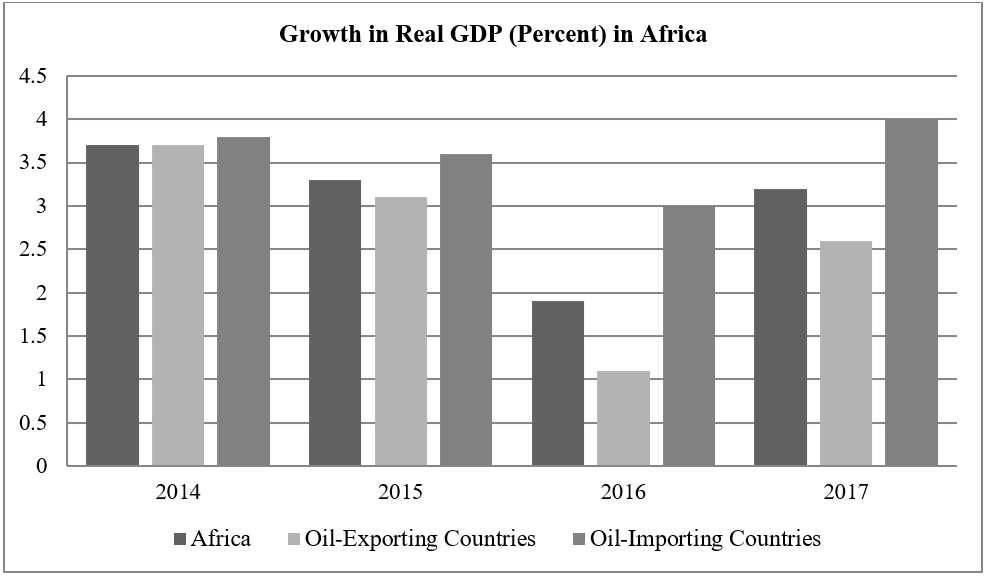

Oil exporting countries in SSA rely heavily on oil revenue, a condition that has tremendous impact on the development of the region – the decline in GDP growth in SSA from 5.1% to 1.4% in 2014 and 2016, respectively, was as a result of a fall in the price of oil, where the price of crude oil fell by 56% within a seven-month period. Oil has a significant impact on African economies. Between 2007 and 2017 oil producing countries on the African continent generated $3.3 trillion in revenue from oil – this amount is more than seven times the value of foreign aid the region has received within the same period. Revenue from oil improves economic output in Africa but fluctuations in the price of oil has an enormous impact on countries in the area – between the middle of 2014 and January 2016, the price of oil declined by 70% as a result of global oversupply of the commodity. This outcome had adverse effect on both oil exporting and oil importing countries in Africa as GDP growth declined .

Source: AfDB, OECD & UNDP

However, an increase in the price of oil is not always deleterious to all net oil-importing countries in Africa as is widely known in energy economics, that an increase in the price of oil will have a positive impact on net oil-exporting countries and conversely an increase in oil prices will have a negative impact on net oil-importing countries . A study published in the volume 139 of Energy (Elsevier) in 2017, defies this analogy - the research work, which focussed distinctively on the impact of oil price shocks on small oil-importing economies suggests that an increase in the price of oil in Liberia (small oil-importing country) stimulates the country’s economy. This is mainly as a result of the intensive labour and capital employed in the process of reallocating resources from oil-intensive sectors when oil prices are high – the economic output of labour and capital when the price of oil increases, far exceeds the contribution of oil revenue in Liberia.

Similarly, findings from another research that was published by Heliyon (Elsevier) in 2019 reveal that net oil-importing developing countries: Cape Verde, Liberia, Sierra Leon and the Gambia respond positively to an increase in global oil prices as GDP per capita increases in the short term in these African countries.

The impact of oil price shocks does not only vary in different countries but it also varies across different sectors of the economy. In 2019, the International Monetary Fund (IMF) released a paper that assessed the impact of declining oil prices on banks in oil-exporting countries in SSA – the findings of the research show that the nature of response for banks to a fall in oil price in SSA depends mainly on the ownership structure of the banks. The impact of declining oil prices on domestic banks is relatively severe as these local banks become illiquid and the value of their financial assets depreciates – this is because indigenous banks in SSA constantly lend to a large number of customers during periods of declining oil prices, and fail to increase funding. The quality of assets deteriorates, leading to an increase in non-performing loans. On the other hand, when oil price declines, foreign banks which are known in Africa to operate with a conservative business model reduce lending and increase the quality of their assets and funding thereby reducing credit growth. In the case of Pan-African Banks (PABs), even though they also increase lending when the price of oil falls, they concurrently reduce their holdings in Government securities - the impact of the decline in oil prices depends largely on the size of the Pan-African Bank. Whiles large PABs record a decline in the quality of assets, small-sized PABs experience an increase in the quality of assets.

Contemporary research has shown that whether a country is an oil exporter or an oil importer, a change in the price of oil has an impact on the expected cash flows of corporations as oil is a valuable commodity across all levels of the economy. According to the International Monetary Fund, oil price shocks have an undeniable influence on stock markets.

Oil price shocks have an impact on inflation, exchange rate, monetary policy, fiscal policy, corporate income and the entire economic activity. In Nigeria , Africa’s largest economy (with GDP of $337 billion) and also the largest oil producer and exporter, where oil accounts for 8.4% of GDP as the economy diversifies, the stock market depicts the golden rule thus, ‘‘oil up, stock down’’ - an increase in oil prices results in a decline of stock returns . In contrast, in South Africa, Africa’s second largest economy and the largest importer of oil on the continent, South African stock returns responds positively to an increase in the price of oil that is caused by a positive shock to demand and reacts negatively to supply shocks. Exhibiting, clearly the variation in the impact of oil price shocks in oil-importing and oil-exporting countries in Africa.

A novel research published in the Journal of African Trade (Elsevier) , which examines the co-movement between oil prices of Organization of Petroleum Exporting Countries (OPEC) and Africa’s six largest Stock markets: South Africa (JSE), Egypt (EGX), Morocco (CSE), Nigeria (NSE), Kenya (NSE) and West African Economic and Monetary Union (BRVM10) indicates that apart from Egypt and South Africa, the co-movement of oil prices and the stock market is relatively low in Africa – whiles the Nigerian stock market and the other stock markets are not adequately developed and poorly integrated into the global oil market, the South African stock market which is by far the largest in Africa and the Egyptian stock market have a strong long-run co-movement with oil prices because they are the most integrated into global finance - a condition that exposes these two stock markets to global oil fluctuations.

However the oil price-exchange rate nexus for the two largest economies on the continent: Nigeria and South Africa seems to be the identical. Although Nigeria is the largest oil exporting country and South Africa is also the largest oil importing country in Africa, empirical studies for the two countries shows that an increase in oil prices leads to a depreciation of both the South African rand and the Nigerian Naira vis‐à‐vis the United States dollar. This prevailing oil price-exchange rate nexus for Nigeria and South Africa is not the same in all dimensions of the two economies and even other parts of the continent – whiles agricultural commodity prices are neutral to global oil prices in South Africa, the situation is quite different in Nigeria. Even though there is no long-run relationship between oil price and any agricultural commodity in Nigeria, in the short-term, oil price has a positive and a significant impact on local food items such as maize and soya bean – oil price also has a negative effect on the price of commodities such as rice and wheat but the impact is negligible . In other parts of Africa, such as East Africa , the dynamics for oil prices and local food prices is quite disparate – analyzing data on the price of petrol and maize suggests that global oil price affects the price of local foods (maize) via transportation cost rather than biofuel or production cost.

About the authors:

Professor Paiman Ahmad is the President of University of Raparin, Rania-Kurdistan Region-Iraq. She holds a PhD in Public Administration from the National University of Public Service Budapest-Hungary, M.A. in International Affairs and Public Policy from Bilkent University in Ankara, Turkey, and B.A. in English Language from Koya University.

Alexander Ayertey Odonkor is the founder and leading expert at the Ghana Centre for China Studies, Africa’s preeminent and most comprehensive platform exclusively dedicated to authoritative interpretation of China’s domestic and foreign policies.

Production credits: This commentary is produced by the Ghana Centre for China Studies.

At the Ghana Centre for China Studies we eschew specific policy positions. All positions and opinions expressed in this publication are solely those of the author (s).

References

- BP ‘‘BP Statistical Review of World Energy 2018’’, 67th Edition. London, UK. Available at:https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2018-full-report.pdf(Accessed: 19 May, 2020).

- African Development Bank Group ‘‘African Economic Outlook 2020: Developing Africa’s Workforce’’ Available at: https://www.afdb.org/en/documents/african-economic-outlook-2020 (Accessed: 19 May, 2020).

- African Development Bank Group ‘‘North Africa Economic Outlook 2018’’ Available at: https://www.afdb.org/fileadmin/uploads/afdb/Documents/Publications/2018AEO/African-Economic-Outlook-2018-North-Africa.pdf(Accessed: 19 May, 2020).

- World Bank (2015) ‘‘Global Economic Prospects: Having fiscal Space and Using it’’ 1818 H Street NW, Washington DC 20433, United States. Available at: https://www.worldbank.org/content/dam/Worldbank/GEP/GEP2015a/pdfs/GEP15a_web_full.pdf(Accessed: 19 May, 2020).

- Coulibaly, B. S. & Madden, P. (2020) ‘‘Strategies for coping with the health and economic effects of the COVID-19 pandemic in Africa’’ Brookings Institution, 18 March [Online]. Available at: https://www.brookings.edu/blog/africa-in-focus/2020/03/18/strategies-for-coping-with-the-health-and-economic-effects-of-the-covid-19-pandemic-in-africa/ (Accessed: 19, 2020).

- Dapel, Z. (2019) ‘‘The Time Is Right for African Nations to Break the Resource Curse’’ Foreign Policy, 1 November [Online]. Available at: https://foreignpolicy.com/2019/11/01/low-oil-prices-exporting-african-economies-break-resource-curse/(Accessed: 20 May, 2020).

- AfDB, OECD, UNDP ‘‘African Economic Outlook 2016: Sustainable Cities and Structural Transformation’’Available at: https://www.afdb.org/fileadmin/uploads/afdb/Documents/Publications/AEO_2016_Report_Full_English.pdf(Accessed: 20 May, 2020).

- International Monetary Fund (2015) ‘‘Global implications of lower oil prices’’ Available at: https://www.imf.org/external/pubs/ft/sdn/2015/sdn1515.pdf(Accessed: 20 May, 2020).

- Gbatu, A.P., Wang, Z., Wesseh Jr. P.K. and Tutdel, I.Y.R.(2017) ‘‘The impacts of oil price shocks on small oil-importing economies: Time series evidence for Liberia.’’ Energy, 139, 975–990. https://doi.org/10.1016/j.energy.2017.08.047

- Gershon, O., Ezenwa, N. E., & Osabohien, R. (2019) ‘‘Implications of oil price shocks on net oil-importing African Countries.’’ Heliyon, 5(8), e02208. Available at: https://doi:10.1016/j.heliyon.2019.e02208

- International Monetary Fund (2019) ‘‘Coping with Falling Oil Prices: The Different Fortunes of African Banks’’ Washington DC, US Available at: https://www.imf.org/en/Publications/WP/Issues/2019/06/17/Coping-with-Falling-Oil-Prices-The-Different-Fortunes-of-African-Banks-46955(Available at: 19 May, 2020).

- International Monetary Fund (2000) ‘‘The Impact of Higher Oil Prices on the Global Economy’’ Washington DC, US. Available at: https://www.imf.org/en/Publications/Policy-Papers/Issues/2016/12/31/The-Impact-of-Higher-Oil-Prices-on-the-Global-Economy-PP77(Accessed: 19 May, 2020).

- Naidoo, P. (2020) ‘‘Nigeria Tops South Africa as the Continent’s Biggest Economy’’ Bloomberg, 4 March [Online].Available at: https://www.bloomberg.com/news/articles/2020-03-03/nigeria-now-tops-south-africa-as-the-continent-s-biggest-economy(Accessed: 19 May, 2020).

- PricewaterhouseCoopers ‘‘Nigeria’s GDP Positive signals for 2017’’ Available at: https://www.pwc.com/ng/en/assets/pdf/economy-alert-march-2017.pdf(Accessed: 19 May, 2020).

- Asaolu,T.O & Ilo, B.M (2012) ‘‘The Nigerian stock market and oil price: A co-integration analysis’’ Kuwait Chapter of Arabian Journal of Business and Management Review, 1 (5) (2012), pp. 28-36

- Chisadza, C., Dlamini, J., Gupta, R. & Modise, M. P. (2016) ‘‘The impact of oil shocks on the South African economy’’, Energy Sources, Part B: Economics, Planning, and Policy, 11:8, 739-745, DOI: 10.1080/15567249.2013.781248

- Gourène, G.A.Z. & Mendy, P. (2018) ‘‘Oil prices and African stock markets co-movement: A time and frequency analysis’’ Journal of African Trade, 5 (1–2) (2018), pp. 55-67, https://doi.org/10.1016/j.joat.2018.03.002

- Fowowe, B. (2014) ‘‘Modelling the oil price–exchange rate nexus for South Africa’’, International Economics, Volume 140, Pages 36-48, ISSN 2110-7017, https://doi.org/10.1016/j.inteco.2014.06.002.

- Muhammad, Z., Suleiman H. & Kouhy, R. (2012) ‘‘Exploring oil price—exchange rate nexus for Nigeria’’ OPEC Energy Review, 36, 383–395. https://doi:10.1111/j.1753-0237.2012.00219.

- Fowowe, B. (2016) ‘‘Do oil prices drive agricultural commodity prices? Evidence from South Africa’’, Energy, Volume 104, Pages 149-157, ISSN 0360-5442, https://doi.org/10.1016/j.energy.2016.03.101.

- Nwoko, I.C., Aye, G.C., & Asogwa, B.C (2016) ‘‘Effect of oil price on Nigeria's food price volatility’’ Cogent Food & Agriculture, 2 (1) doi.org/10.1080/23311932.2016.1146057

- Dillon, B.M & Barrett C.B (2016) ‘‘Global Oil Prices and Local Food Prices: Evidence from East Africa’’, American Journal of Agricultural Economics, Volume 98, Issue 1, January 2016, Pages 154–171, https://doi.org/10.1093/ajae/aav040